by Paul R. Spitzzeri

In its seminal report on the early years of the City of Industry, the Stanford Research Institute devoted significant attention to “Economic Characteristics and Trends” in the city. The first area of discussion concerned land area in Industry, using data provided by the city engineer and the city’s auditing firm, Frazer and Torbet.

Upon incorporation in June 1957, the city’s area was about 5 square miles or just under 3,200 acres. It was an era, however, of significant annexation throughout the eastern San Gabriel Valley and the city grew dramatically, with over sixty taking place in succeeding years. The area then. by mid-1964, nearly doubled to 9.77 square miles and some 6,250 acres.

As for population, the county’s regional planning commission, in mid-1956, estimated the number of residents in the proposed city to be about 624, but a slightly reduced area actually incorporation brought that number down to 588. Changes in number during the next five years were attributed to “annexation and exclusion of land parcels,” though the people on some of these parcels could be quite small.

In any case, population climed to near 700 after the first year of the city’s existence and then added another hundred persons to a peak of about 800 in 1959. By mid-1963, the population was determined to be about 750. It is now stated that the number of residents is just over 200, a significant change over the decades.

A major indicator of growth would be based on issued building permits and the value involved. In the first year, this value was abouit $1.1 million, but this climbed to $3.7 million the next year and to a peak of $6.2 million in 1961, with values of $4.5 and $5.5 million in the following two years. It was observed, however, that the issuing of permits does not mean that projects were actually built, although it was also noted that permit values were often understated. Notably, it was stated that “for every $100 of building permits issued there should be a $25 increase in the assessed value of improvements on real property.,” because assessments were generally 25% of market value.

This led to a discussion on assessed valuation with some distinctions made about changes in value. For one thing, the near doubling of area within the city was a major factor. Secondly, assessments were transferred from the county assessor to the state’s Board of Equalization, with the latter dealing primarily with land, not improvements on property. Specifically, the report noted “in City of Industry the transfer of privately owned lands assessed by the County of Los Angeles to ownership by public utilities assessed by the State Board of Equalization accounts for the major portion of the total increase in value of state-assessed land.”

Finally, the county assessor’s methods changed, both in terms of field work and in processing information, given the $18 million change over five years from 1958 to 1963, with 40% of this happening in the last year, after the fall 1962 election led to changes in policy with that office, including increases in determining value for unsecured property (considered so if the taxpayer incorrectly filled out a return or if there wasn’t enough information for the property to be considered secured.)

Regardless, the report determined that the growth of assessment value was “a certain reflection of the vigorous growth of businesses locating in City of Industry over the very short span 1958 through 1963.” It also noted that sharp increase in valuation per acre, from under $1,500 to nearly $1,800 during those six years. This was partly a function of annexation and a change in zoning type (from agriculture to industrial, largely). It did note, though, that, in the mid-1960s, “some six-sevenths of the land within City of Industry continues to be used for agricultural purposes.” Notably, changes in assessment usually occurred when the property changed from agriculture to industrial, but not until increased value came after “am overassessment of the improvements put upon the land.”

When it came to property and other taxes, there was a complication because of such aspects as school and special tax districts, as well as fire and water, so the county was divided into code areas. The report laid out some summary matters, including the fact that “tax rates do not apply uniformly to the total assessed valuation, even within a single code area.” What was difficult is that some taxing entities only worked with land value, while others included improvements.

It was also observed that there was a heavier burden on property that was mostly land compared to one that was largely improved. Because it was hard to secure reliable data for a weighted average tax burden for property, there was a ratio for property that had land, improvements and personal property elements. For the city, there was a much higher percentage of valuation in personal property than in the county and state broadly, while improvements were notably lower. This meant more business inventory with the former (personal property was considered underreported in the larger jurisdictions), though the change in the county asssessor’s office after the 1962 elections leading to policy revisions in how land was classified also was cited.

Tax exemptions also varied significantly and this was considered minimal in the city, because there were few government buildings or land and improvements owned by religious, charitable and educational entities. There were also disparities in how the county and state assessment agencies did their work and the issue of what constituted secured and unsecured property in the eyes of the county assessor’s staff. Moreover, different agencies relied on varying ratios of valuation to full market value.

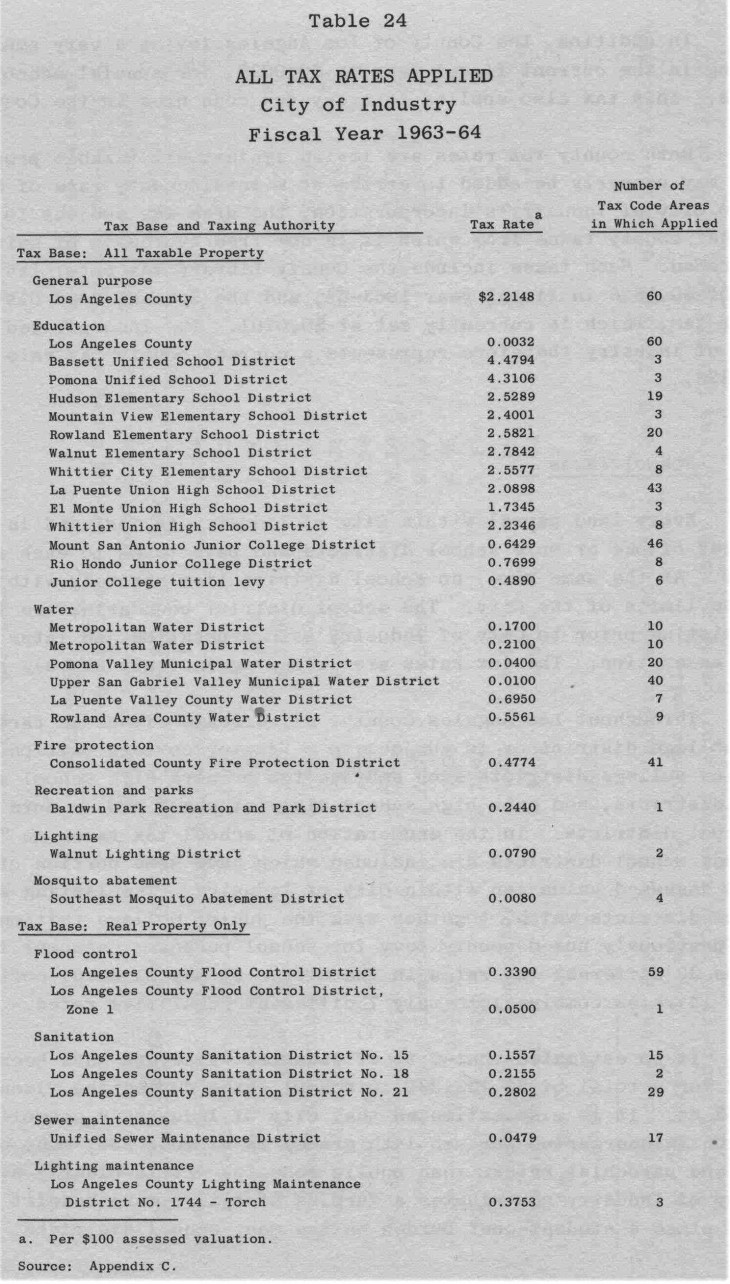

Also of interest is a table of all applies tax rates for the city in the fiscal year 1963-64, including general purpose, education, water, fire protection and other districts, as well as the tax bases for flood control, sanitation, sewer and lighting infrastructure. Each of the categories was discussed in some detail and it is noteworthy, for example, that city taxpayers contributed about $2.7 million in revenues for 1963-64, although there were probably only 250 school-age children residing in the city (this is a larger number than the current entire population of Industry now.)

Taxable transactions, including retail ones, were also discussed and a table showed that the increase was five-fold for total transactions and nearly six-fold for retail ones, with much of the growth in the latter coming after 1961, while most of the other transaction growth was in the first couple of years of the city’s existence.

Next week, we’ll move to “Fiscal Policies and Practices” as well as matters relating to transportation and utilities and services.

The population of ‘residents’ in the City of Industry has always made for interesting counting. I believe that the largest single concentration has always been the El Encanto convalescent hospital.

The patients/residents have numbered up to several hundred or more at times. Because of the longer length of stays compared to an acute care hospital (greater than 30 days) has meant that perhaps they can/have transitioned from being a resident of the city they came from to becoming a resident of the City of Industry.

How these folks are counted (or not) over the years has been the source of much discussion. (maybe more from outside of the City of Industry) The question of whether the extended stay patients can or do become voters in the City of Industry due to their change or residency has also been a point of discussion over the years.

I understand that if you have an extended stay in the Industry Hills hotel you are required to change rooms every 14 days to prevent your becoming a legal resident (voter?) in the city.

So how the ‘population’ has been counted in the City of Industry over the years has sometimes been as difficult to pin down as the tax valuations that you have highlighted. The City of Industry, certainly a non-traditional non-stereotypical city.